Some Known Factual Statements About Guided Wealth Management

Some Known Factual Statements About Guided Wealth Management

Blog Article

Guided Wealth Management Fundamentals Explained

Table of ContentsGuided Wealth Management - QuestionsGuided Wealth Management for DummiesGetting The Guided Wealth Management To WorkSome Known Details About Guided Wealth Management Get This Report about Guided Wealth Management

The expert will establish up a property allotment that fits both your risk tolerance and threat capacity. Possession appropriation is just a rubric to identify what percent of your total monetary portfolio will certainly be dispersed across various asset classes.

The typical base income of a monetary advisor, according to Undoubtedly as of June 2024. Anyone can work with an economic consultant at any type of age and at any kind of stage of life.

The 10-Minute Rule for Guided Wealth Management

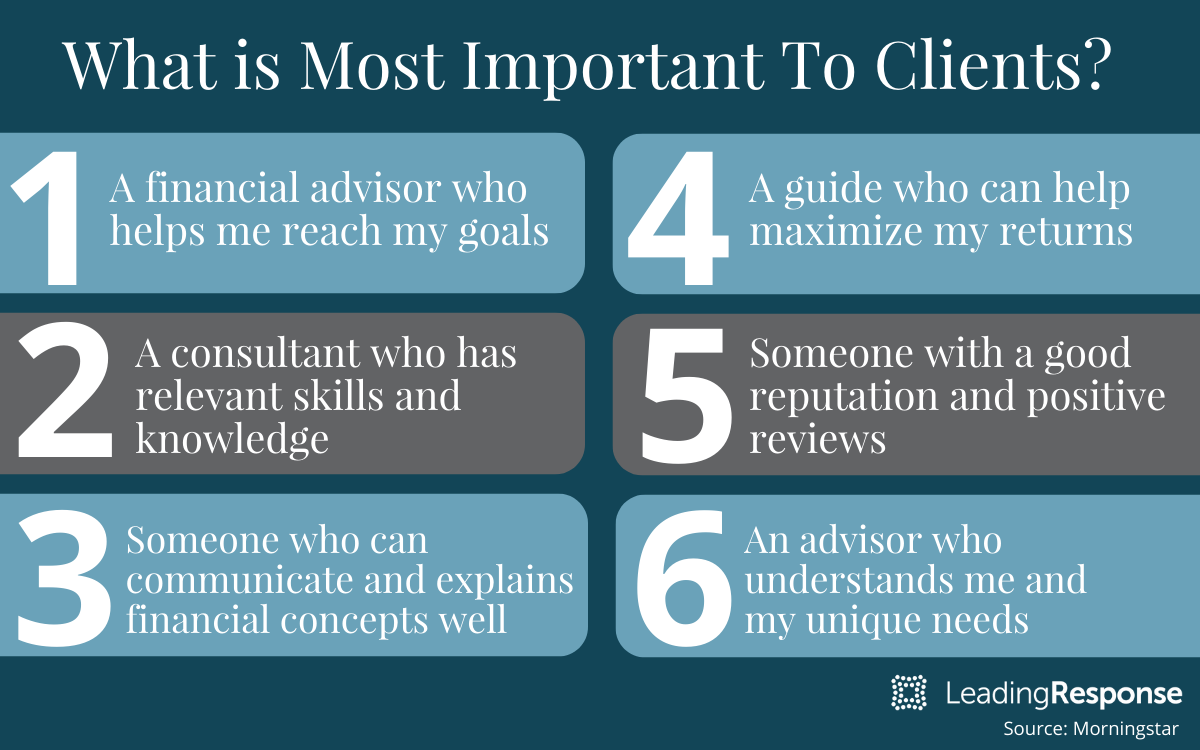

Financial consultants work for the client, not the firm that utilizes them. They ought to be responsive, prepared to describe financial principles, and maintain the client's ideal rate of interest at heart.

An expert can recommend possible improvements to your strategy that may assist you achieve your goals more successfully. If you don't have the time or rate of interest to manage your finances, that's one more great factor to work with a financial expert. Those are some basic factors you may need an advisor's professional assistance.

Seek an expert that concentrates on informing. A good monetary expert shouldn't simply sell their solutions, however provide you with the devices and sources to become monetarily wise and independent, so you can make educated choices by yourself. Seek an expert that is enlightened and well-informed. You desire an advisor who remains on top of the monetary scope and updates in any kind of location and that can address your monetary questions concerning a myriad of topics.

Rumored Buzz on Guided Wealth Management

Others, such as qualified financial planners(CFPs), already adhered to this standard. Yet also under the DOL guideline, the fiduciary requirement. financial advisor brisbane would certainly not have actually put on non-retirement recommendations. Under the viability criterion, financial experts typically work with compensation for the items they market to clients. This means the client might never ever obtain a costs from the financial expert.

Fees will additionally vary by location and the advisor's experience. Some experts might offer lower rates to aid clients who are simply obtaining started with economic preparation and can't afford a high monthly price. Generally, an economic advisor will certainly provide a complimentary, initial consultation. This examination provides a possibility for both the client and the advisor to see if they're a great fit for each various other - https://www.slideshare.net/bradcumner4020.

A fee-based consultant may gain a fee for creating an economic strategy for you, while likewise earning a payment for offering you a particular insurance coverage item or investment. A fee-only financial consultant gains no compensations.

Get This Report about Guided Wealth Management

Robo-advisors don't need you to have much cash to get started, and they cost less than human financial consultants. A robo-advisor can not speak with you about the finest method to get out of financial debt or fund your youngster's education and learning.

An advisor can assist you identify your savings, how to develop for retirement, help with estate planning, and others. If however you just require to talk about portfolio appropriations, they can do that also (usually for a fee). Financial advisors can be paid in a number of ways. Some will be commission-based and will make a percent of the items they steer you into.

Examine This Report about Guided Wealth Management

Marriage, separation, remarriage or merely relocating in with a brand-new companion are all turning points that can require cautious preparation. Along with the commonly hard emotional ups and downs of divorce, both companions will have to deal with crucial monetary factors to consider. Will you have adequate revenue to sustain your way of life? Just how will your financial investments and other properties be divided? You might quite possibly require to alter your monetary method to maintain your objectives on course, Lawrence says.

An abrupt influx of cash or properties raises prompt questions regarding what to do with it. "An economic advisor can help you analyze the means you might place that cash to pursue your individual and financial goals," Lawrence says. You'll desire to consider just how much might go to paying down existing financial debt and just how much you might think about spending to pursue a more safe and secure future.

Report this page